Reporting Gambling Winnings On Form 1040

More Articles

Gambling wins are reported on the front page of Form 1040 for tax years 2017 and prior. Gambling wins are reported on Schedule 1, Line 21 for tax year 2018. Wheel of fortune game show. All gambling wins are required to be reported even if the casino doesn’t report the win to the IRS. Winnings: If reported on a W2G, enter gambling winnings on screen W2G. Otherwise, enter the total amount in the Gambling winnings field of line 21 on screen 3 - Income. In Drake18, the amount of gambling winnings flows to line 21 of Schedule 1 and then the sum of lines 10-21 flows to Form 1040, line 6.

- Report your total gambling winnings in Other Income on Line 21 of your tax return Form 1040. You cannot use any other personal income tax returns, such as Form 1040EZ, to report winnings from gambling. Deduct the amount of your gambling losses as an itemized deduction on Schedule A of Form 1040.

- A payer is required to issue the gambler a Form W-2G if they receive certain gambling winnings or if you have any gambling winnings subject to Federal income tax withholding. You must report the full amount of your gambling winnings for the year on Form 1040 regardless of whether any portion is subject to withholding.

- You must report all gambling winnings (including lotteries, raffles) on line 21, Schedule 1, Form 1040 as 'Other Income') including winnings that aren't reported on a Form W-2G.pdf. When you have gambling winnings, you may be required to pay an estimated tax on that additional income.

If you had a successful night at the slots or poker tables, you're going to have to share some of the lucky proceeds with Uncle Sam. The Internal Revenue Service generally requires that you report your gambling winnings and losses separately when you file your taxes rather than combining the two amounts.

Record Keeping

As you gamble during the year, you need to keep records of your winnings and losses so that you can support whatever figures you report on your taxes. The IRS permits you to use per-session recording, which means that instead of recording whether you won or lost each time you pull the slot machine, you can simply record your total for the session. Face book free slot games. Your records should include the date and type of gambling, where you gambled and if you gambled with anyone else, such as a home poker game. If you win more than $600, you should receive a Form W-2G from the casino.

Taxable Winnings

When figuring your gambling winnings, only include the winnings from each session rather than using losses to offset your gains. You have to include gambling winnings even if you didn't receive a Form W-2G from the casino. For example, if you gambled six times during the year, winning $100, $3,000, $4,000 and $6,000 but losing $5,000 and $2,000, your gambling winnings for the year are $13,100. This amount gets reported on line 21 of your Form 1040 tax return.

Gambling Losses

To claim your gambling losses, you have to itemize your deductions. Gambling losses are a miscellaneous deduction, but -- unlike some other miscellaneous deductions -- you can deduct the entire loss. The deduction goes on line 28 of Schedule A and you have to note that the deduction is for gambling losses. For example, if you lost $5,000 on one occasion and $7,000 on another, your total deduction is $12,000.

Gambling Loss Limitation

You can't deduct more in gambling losses than you have in gambling winnings for the year. For example, suppose you reported $13,000 in gambling winnings on Line 21 of Form 1040. Even if you lost $100,000 that year, your gambling loss deduction is limited to $13,000. Worse, you aren't allowed to carry forward the excess, so if you had $87,000 in losses you couldn't deduct last year, you can't use that to offset the gambling income from the current year.

Video of the Day

References (2)

Photo Credits

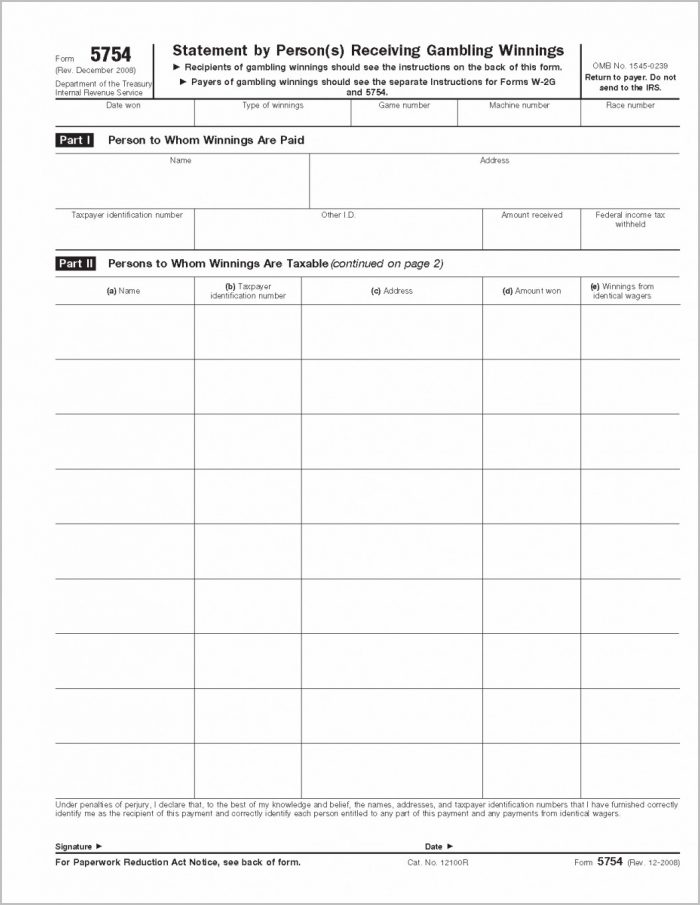

- tax forms image by Chad McDermott from Fotolia.com

About the Author

Where Do You Report Gambling Winnings On Form 1040

Based in the Kansas City area, Mike specializes in personal finance and business topics. He has been writing since 2009 and has been published by 'Quicken,' 'TurboTax,' and 'The Motley Fool.'